28 Mar Share startup and investment goods

In October 24th, Shenzhen Dayangbang team visited Longling Capital for communication Cai Wensheng, the chairman of Longling Capital, held a closed-gate sharing meeting with Shenzhen Dayangbang teacm at Atwork, in which he mentioned:

The direction and product positioning of start-ups:

1. Three principles one must obey for his product: demands, advantages, benefits;

2. Try not to involve into copyright disputes and grey zone, and better not to tangle with government and strong competitors;

3. Develop by the method of network alliance and form an industry chain;

4. Adjust and change the strategy once the chances are slim;

5. Product name should have strong readability and easily go viral; it should symbolize good fortune and be registered;

The preparation for the meeting with an investor:

1. Know your investor

2. Make the business proposal appealing;

3. Cut the crap

4. Don’t exaggerate or use false data;

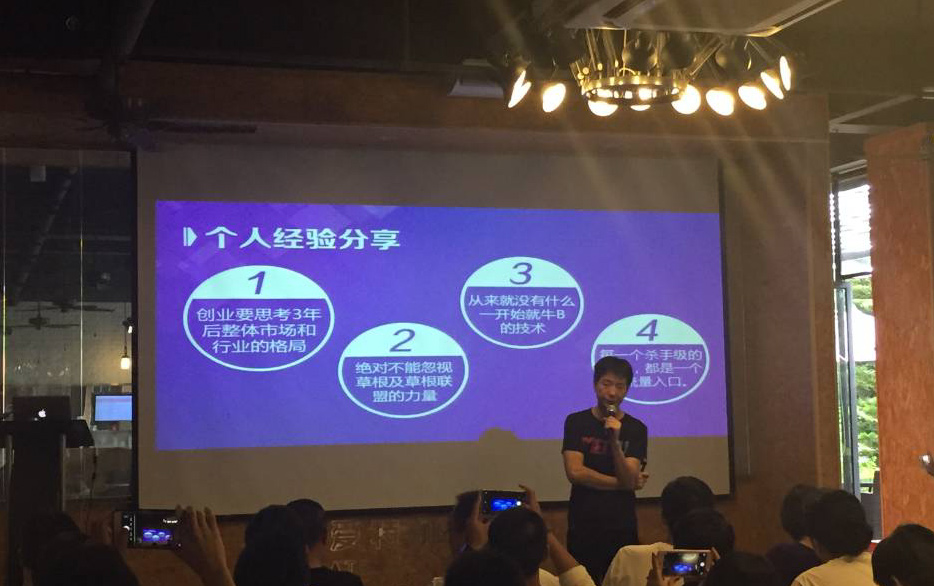

Tersonal experience sharing:

1. You should think about the overall market and industry pattern after 3 years;

2. The power of grassroots and grassroots coalitions must never be ignored;

3. There’s never been an awesome technology in the first place;

4. Every killer app is an flow entrance

5. You can start the project while working, perfect your ideas and find investment;

6. If founders and executives of a start-up are paid high wages, the chances of success are low.

7. In the process of starting a start-up, the investment is also a manifestation of the ability.

简体中文

简体中文